29+ paycheck calculator arkansas

Just enter the wages tax. Web Arkansas Income Tax Calculator 2021.

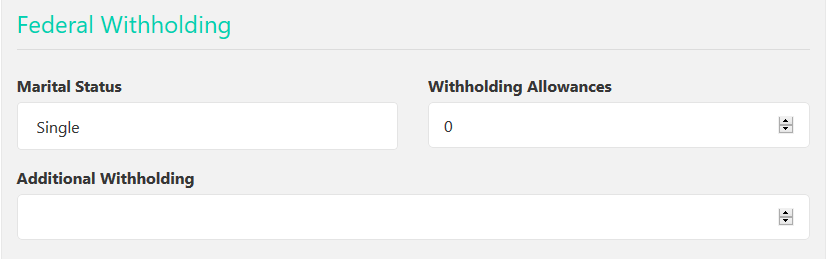

Federal And Arkansas Paycheck Withholding Calculator

Web Calculate your Arkansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

. The 2022 rates range from 03 to. Web Arkansas Paycheck Calculator Use ADPs Arkansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Arkansas employers pay unemployment tax at rates ranging from 01 to 50 plus the stabilization rate in effect for the current year.

Web Paycheck Calculator Arkansas. The State of Arkansas levies a progressive tax rate which means the tax increases with a higher income. Paycheck calculators are great tools to have available in.

A stabilization rate that changes each year is added to come up with your total tax rate. Using A Paycheck Calculator To Calculate Your Income Tax Payment. Web Arkansas State Unemployment Insurance As an employer in Arkansas you have to pay unemployment insurance to the state.

Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Web Arkansas Salary Paycheck Calculator Results Below are your Arkansas salary paycheck results. Once done the result will be your estimated take-home pay.

Web Rates for Arkansas unemployment tax vary and range between 01 to 50. Web Use our free Arkansas paycheck calculatorto determine your net payor take-home pay by inputting your period or annual income along with the necessary. If youre a new business then youll pay a.

Web The Arkansas Tax Calculator Estimate Your Federal and Arkansas Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing. Web Calculating your Arkansas state income tax is similar to the steps we listed on our Federal paycheck calculator. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

In 2023 the tax rates ranged. Web Arkansas Arkansas Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the. If you make 70000 a year living in the region of Arkansas USA you will be taxed 12387.

Web First you must know the income tax rates. Figure out your filing status work out your adjusted. Your average tax rate is 1198 and your.

Paycheck Results is your gross. Web Simply follow the pre-filled calculator for Arkansas and identify your withholdings allowances and filing status. Supports hourly salary income and multiple pay frequencies.

The results are broken up into three sections.

Arkansas Paycheck Calculator Tax Year 2022

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Arkansas Paycheck Calculator Tax Year 2022

Free Online Paycheck Calculator Calculate Take Home Pay 2023

3 Bhk Apartments For Sale In Shivaji Park Mumbai 10 3 Bhk Apartments In Shivaji Park Mumbai

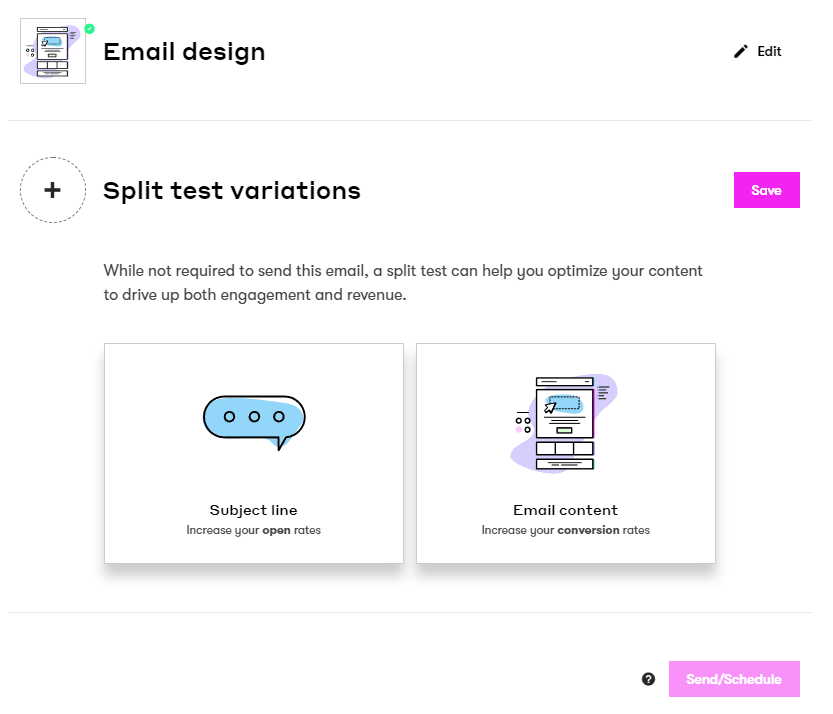

Activecampaign Vs Drip My Unbiased Opinion 2023

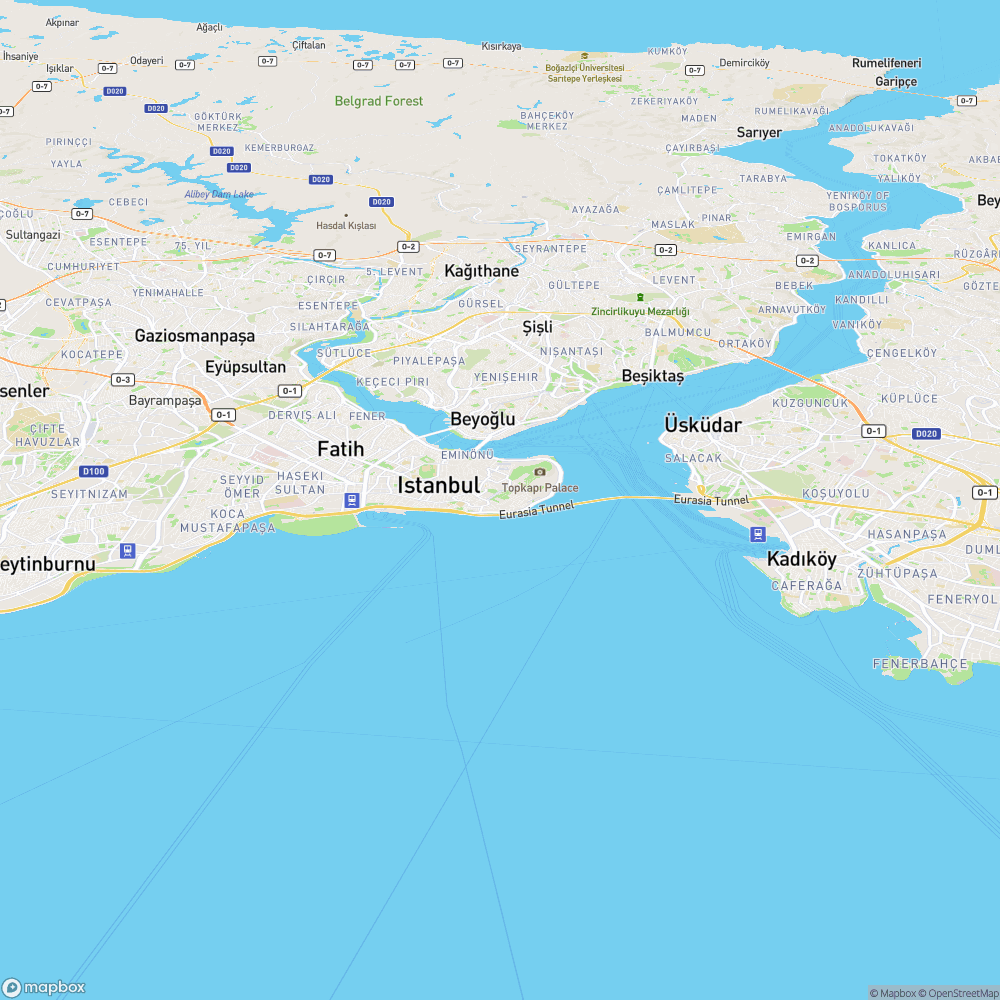

Istanbul For Digital Nomads

Refined Clothing Business Plan By Gemma922 Issuu

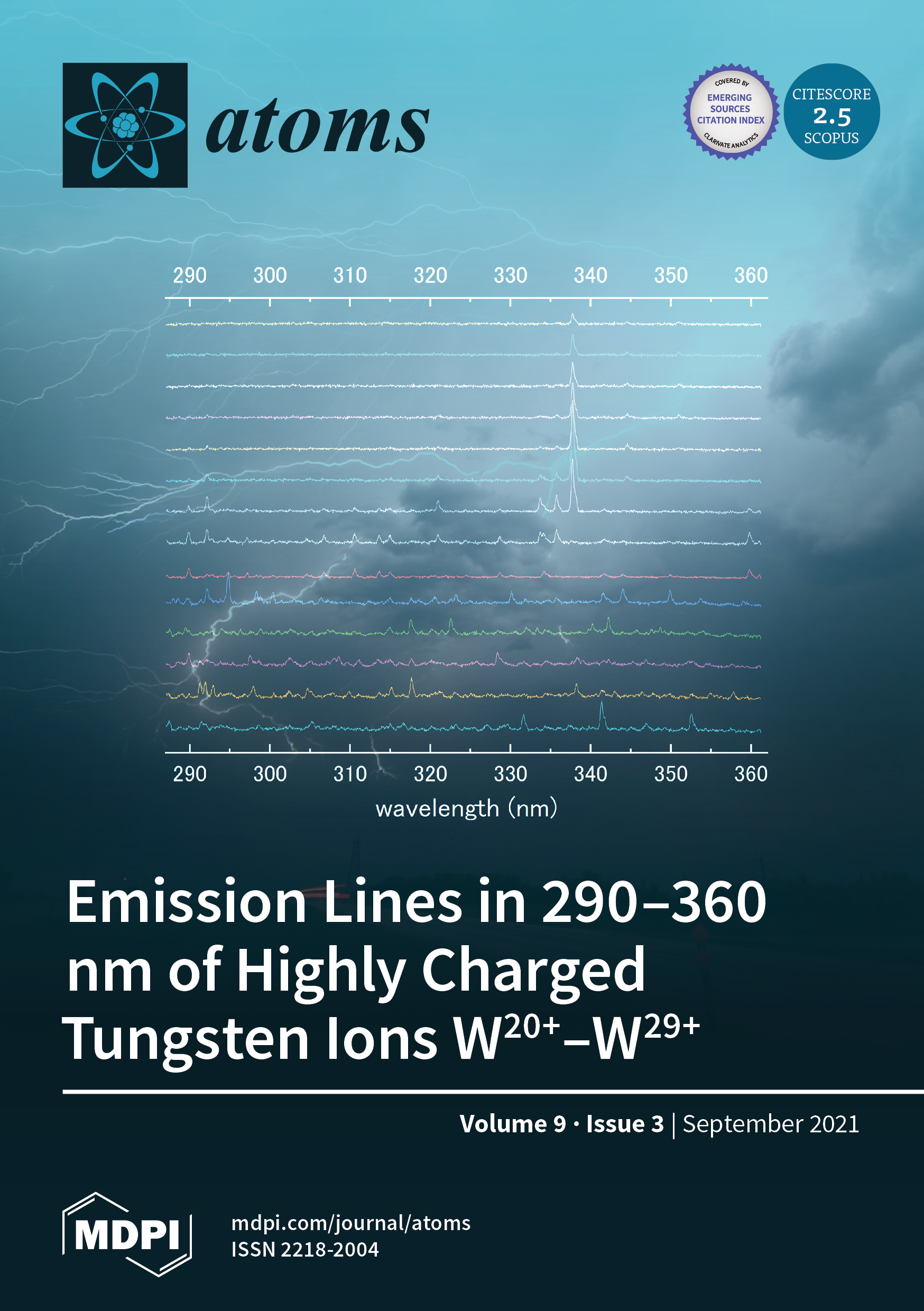

Atoms September 2021 Browse Articles

Premium Photo New Tax Forms With A Beautiful Handle Laid Out To Fill On A Wooden Table The Concept Of Documents

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Arkansas Salary Paycheck Calculator Gusto

How To Make A College Budget You Ll Actually Stick To Lvd Letters

Free March Madness College Basketball Picks Best Bets Today

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Autism Vs Adhd Differences Similarities

Us Paycheck Calculator Queryaide